The Exit No One Wants to Think About

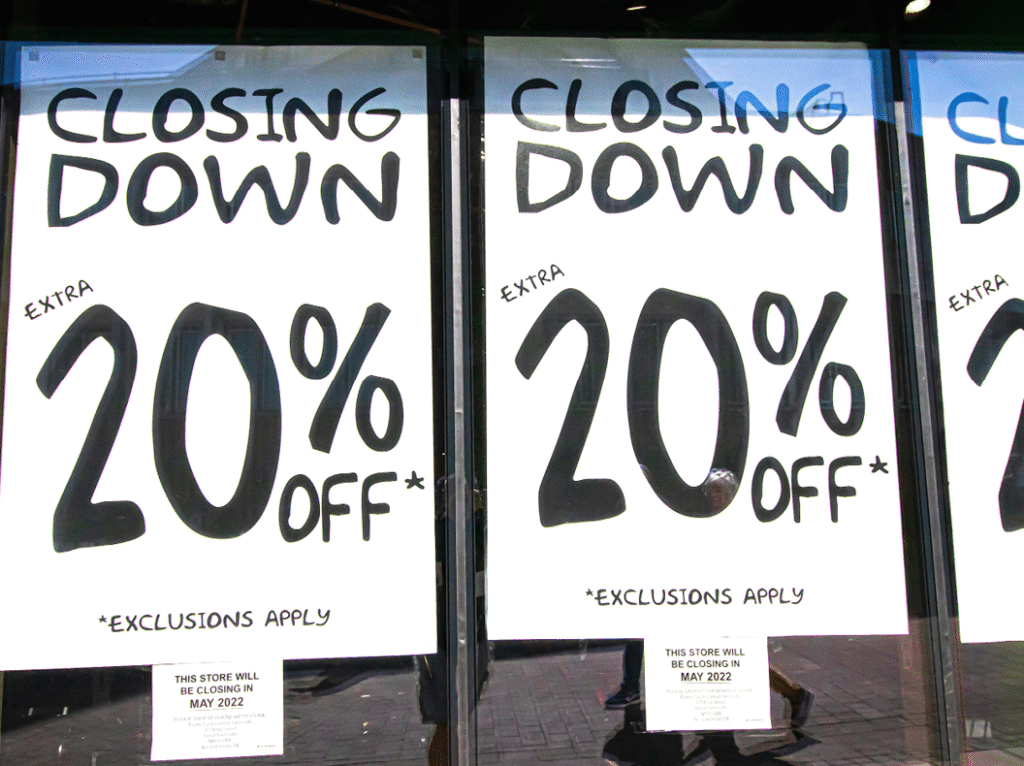

Many business owners spend years building something great, only to find themselves unprepared when the time comes to exit. The worst time to sell a business is when you have to. Desperation leads to rushed decisions, lower valuations, and limited options.

Exit planning isn’t just for those ready to retire. It’s about setting your business up for long-term success and giving yourself the freedom to choose when and how to step away. By making strategic moves now, you can create a business that thrives with or without you – maximising its value and your future options.

The High Cost of Leaving It Too Late

Too many owners put off exit planning until they are forced to sell, often due to burnout, financial strain, or unexpected life events. This lack of preparation comes at a high price:

- Lower business valuation – Buyers spot weaknesses quickly. If your financials are messy, your processes undocumented, or your leadership team weak, expect a lower offer.

- Limited buyer interest – The best buyers want businesses that can run independently. If you’re still the decision-maker in everything, it raises red flags.

- Rushed decisions – Urgency leads to poor negotiations. When you’re selling under pressure, you have less leverage and fewer options.

- Emotional strain – A forced sale often results in regret. Selling should be a strategic, empowering decision – not one driven by exhaustion or desperation.

How to Position Your Business for a Smart Exit

Even if you have no immediate plans to sell, preparing for an exit makes your business stronger, more efficient, and more valuable.

- Get Your Financials in Order

- Ensure your financials are clean, accurate, and well-documented – buyers expect transparency.

- Regularly track and report key financial metrics as if you were already preparing for a sale. [If you need help, consider getting a Financial Insights Report]

- Build a Business That Runs Without You

- Develop a leadership team capable of making decisions without your constant involvement. [Further reading: How to choose a Leadership Program for your leaders.]

- Document key systems and processes – buyers look for businesses that can operate smoothly post-sale.

- Strengthen recurring revenue streams, long-term contracts, and a diversified customer base.

- Understand Your Business Valuation (and What Drives It)

- Many owners don’t know what their business is actually worth – get a professional valuation.

- Learn what factors drive value in your industry (e.g. profitability, scalability, market positioning).

- Identify weaknesses that could be improved to increase your valuation over time.

- Explore Exit Options Before You Need Them

- Selling isn’t the only path – management buyouts, private equity investment, or family succession could all be viable options.

- Engage with potential buyers or advisors well before you plan to exit.

- Understand the timeline – most successful business sales take 6-9 months, to structure properly – but only if you’ve done the preparation properly in advance. Otherwise, it can sometimes takes years!

The Unexpected Benefit: A Business You Might Want to Keep

A funny thing happens when owners start preparing their business for exit: many fall back in love with it.

- A business that is exit-ready is often more enjoyable to run – less dependent on you, more profitable, and strategically positioned for growth.

- Some owners find renewed energy and decide to hold onto their business longer, enjoying the benefits of their newly refined operation.

- For others, having a structured exit plan provides the confidence to move on, whether that means retirement or pursuing new ventures.

Take Away: Give Yourself the Freedom to Choose

Exit planning isn’t just about selling, it’s about control. By preparing now, you ensure that when the time comes, you have the best options available, whether that means selling, stepping back, or continuing to grow on your terms.

The best time to start? Long before you need to.

*Or book a call with our team to talk to one of our Exit experts.